CUSTOM JAVASCRIPT / HTML

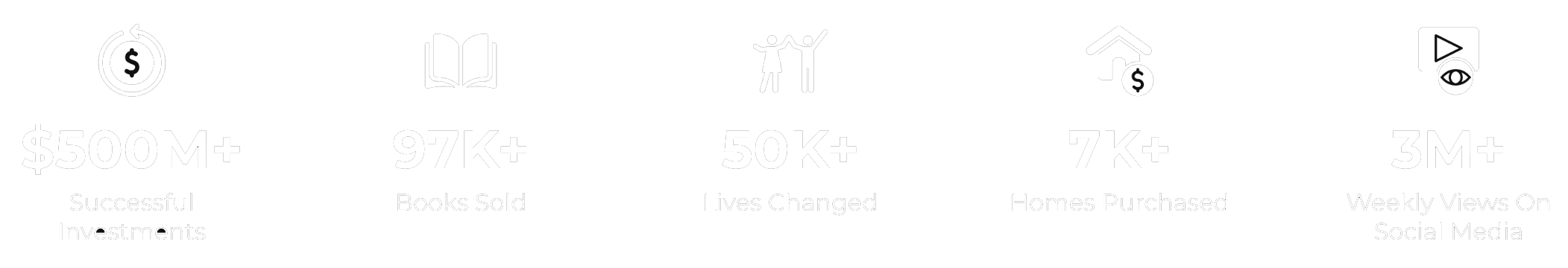

KRIS KROHN

REAL ESTATE INVESTOR | BUSINESS COACH | BEST-SELLING AUTHOR | BREAKTHROUGH MENTOR

CUSTOM JAVASCRIPT / HTML

TAKE CONTROL OF

YOUR LIFE.

If you’re ready to elevate yourself to the next level, you’ve come to the right place

TAKE CONTROL OF

YOUR LIFE.

If you’re ready to elevate yourself to the next level, you’ve come to the right place

GET STARTED HERE.

As long as you’re willing to stay committed, YOU CAN HAVE IT ALL.

IT ALL STARTS WITH A

GAME PLAN

"What made me great in life, business and in real estate was not what I knew, it wasn’t even who I knew, it was my commitment that got me where I am today.” - Kris Krohn

If you’re ready to commit to the future you deserve, a Complimentary Game Plan is what you need to kickstart your journey.

LET'S FIND YOUR WAY.

EVERY JOURNEY STARTS WITH A FIRST STEP. CHOOSE YOUR PATH BELOW.

IT ALL STARTS WITH A

GAME PLAN

"What made me great in life, business and in real estate was not what I knew, it wasn’t even who I knew, it was my commitment that got me where I am today.”

- Kris Krohn

If you’re ready to commit to the future you deserve, a Complimentary Game Plan is what you need to kickstart your journey.

LET'S FIND YOUR WAY.

EVERY JOURNEY STARTS WITH A FIRST STEP. CHOOSE YOUR PATH BELOW.

“This course is the best thing to ever happen to me. In three and a half weeks, I have made $33K in profit. Kris opened my eyes to something I never believed could be so easy and I can't wait to see what I can accomplish in 6 months!"

- Steve

WHO IS KRIS KROHN?

Kris Krohn is the man with the power, the knowledge,

and the determination to change your life.

WHO IS KRIS KROHN?

Kris Krohn is the man with the power, the knowledge, and the determination to change your life.

- 2003: Purchased his first home while in college at 23.

- 2006: Graduated college with 25 homes and financially free.

- 2006: Wrote "The Strait Path to Real Estate Wealth" documenting the BEST wealth building Real Estate strategies.

-

2007: Started his own company to help investors transact the best turn key real estate.

-

2009: Man-handled the recession for mega profits while mastering out-of-state investing for maximum growth and cash flow

-

2015: Launched YouTube channel, wrote more books, held incredible events. Thousands of successful students.

-

2018: Officially transacted over 4,000 deals and a billion dollars in real estate while averaging over 25%+ ROI.

-

2021: Officially transacted over 5,500 deals, still averaging returns of over 25%+ROI with partners around the world.

-

2022: Launched his Investor club and owns hundreds of businesses worldwide.

-

2023: Officially transacted over 6,500 deals reaching ROI's over 34% with partners around the world.

kris krohn on tiktok

CUSTOM JAVASCRIPT / HTML

KRIS KROHN ON YOUTUBE

CUSTOM JAVASCRIPT / HTML

KRIS KROHN ON INSTAGRAM

CUSTOM JAVASCRIPT / HTML

kris krohn on tiktok

CUSTOM JAVASCRIPT / HTML

KRIS KROHN ON YOUTUBE

CUSTOM JAVASCRIPT / HTML

KRIS KROHN ON INSTAGRAM

CUSTOM JAVASCRIPT / HTML

PARTNER WITH KRIS

Whether you’re looking for a hands-on way to break into real estate without money or credit, or you want to leverage your assets to own hands-off real estate that’s fully done for you, you’ve got options.

PARTNER WITH KRIS

SEND ME A TEXT

Ready to get started, but not sure how?

You may need a successful mentor with a proven track record to show you the way. If you feel like Kris Krohn is the right mentor for you, text the word “MENTOR” to his personal cell now.

INFORMATION

QUICK LINKS

EVENT CONTACT

SUPPORT

You may need a successful mentor with a proven track record to show you the way. If you feel like Kris Krohn is the right mentor for you, text the word “MENTOR” to his personal cell now.

INFORMATION

Address:

1440 N Moon River Dr.

Provo, UT 84604